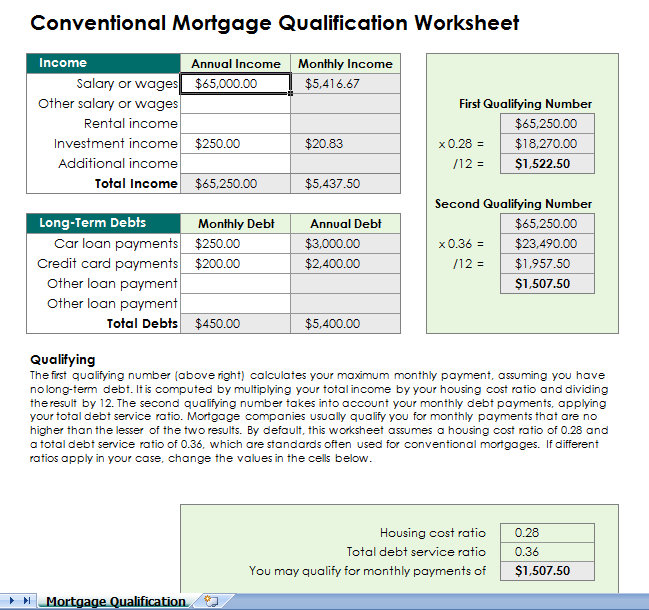

Learning how a lender calculates your monthly mortgage payment can give you a better idea of how much home you can afford. Mutual of Omaha Mortgage wants to make sure this decision is made with the best information available to you. Understanding how your monthly mortgage payment will fit into your budget is an important first step when buying a new home. Lending services may not be available in all areas.Some jumbo loan options may not be available to first-time home buyers.Some loan options may not be available in all states.You’ll have an escrow account for payment of taxes and insurance.Your credit score is over 720, or 740 for certain jumbo loan options.Your debt-to-income ratio is less than 30%.Closing costs will be paid up front, not rolled into the loan.If refinancing, you’re not taking cash out.You’re buying or refinancing a single-family home that’s your primary residence.For all rates shown, unless otherwise noted, we assumed: Assumptions Lenders calculate rates using assumptions: basic loan details. The Annual Percentage Rate (APR) is 3.619%. Some state and county maximum loan amount restrictions may apply. The actual payment amount will be greater. Payment does not include taxes and insurance premiums. Thereafter, the monthly loan payment will consist of equal monthly principal and interest payments only until the end of the loan. For mortgages with a loan-to-value (LTV) ratio of 92.51%, the 0.8% monthly MIP will be paid for the first 30 years of the mortgage term, or the end of the mortgage term, whichever comes first. Payment includes a one time upfront mortgage insurance premium (MIP) at 1.75% of the base loan amount and a monthly MIP calculated at 0.8% of the base loan amount. The VA loan is a benefit of military service and only offered to veterans, surviving spouses and active duty military.

The Annual Percentage Rate (APR) is 2.874%. The payment on a $247,000, 30-year fixed-rate loan at 2.49% and 92.51% loan-to-value (LTV) is $974.67 with 2.125 Points due at closing. Payment does not include taxes and insurance. One point is equal to one percent of your loan amount.

0 kommentar(er)

0 kommentar(er)